A major draw for Ehodler users is the features with which you can use to evaluate a strategy and select one that’ll work best for them. Ehodler offers different types of tools to help investors make the best choice when selecting a strategy.

Ehodler recommends the use of the feature for newbies, these features include a track record, risk factor, a performance chart, strategy description and illustration, lifetime returns, trades carried out by the strategy, amount currently managed and investors in the pool and average daily performance.

I will show you how to select and start using your first strategy on Ehodler.

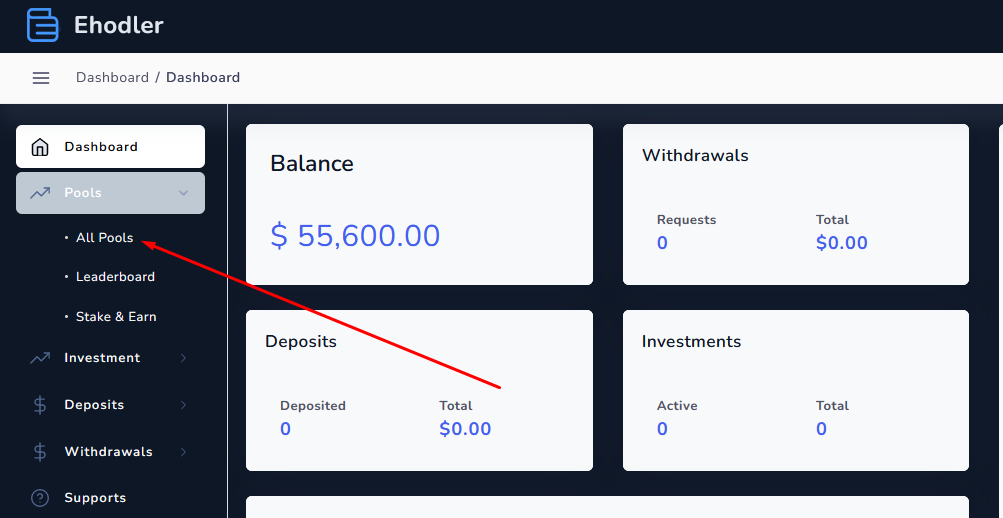

- Login into your account, you’ll be redirected to a user dashboard, Click on pools and select all pools.

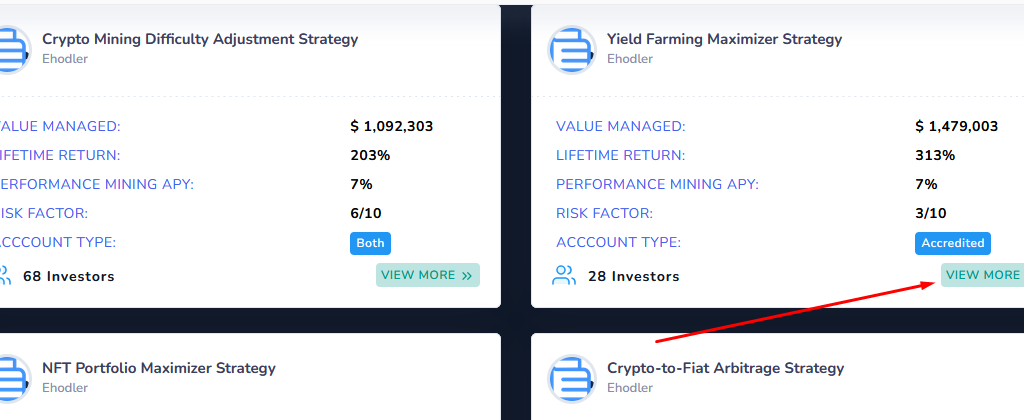

- You will be redirected to the strategy page where you can see all the strategies offered by Ehodler, select view more on any strategy to see more information about the strategy.

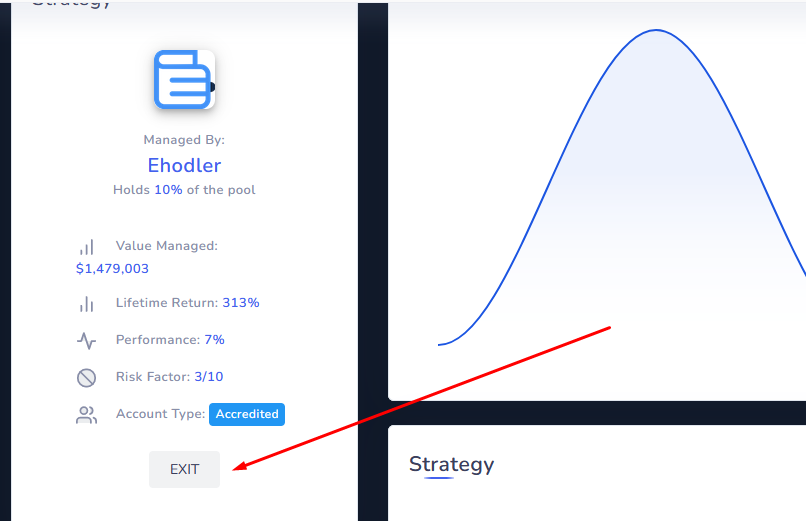

Once the pool loads you’ll see all information about the pool.

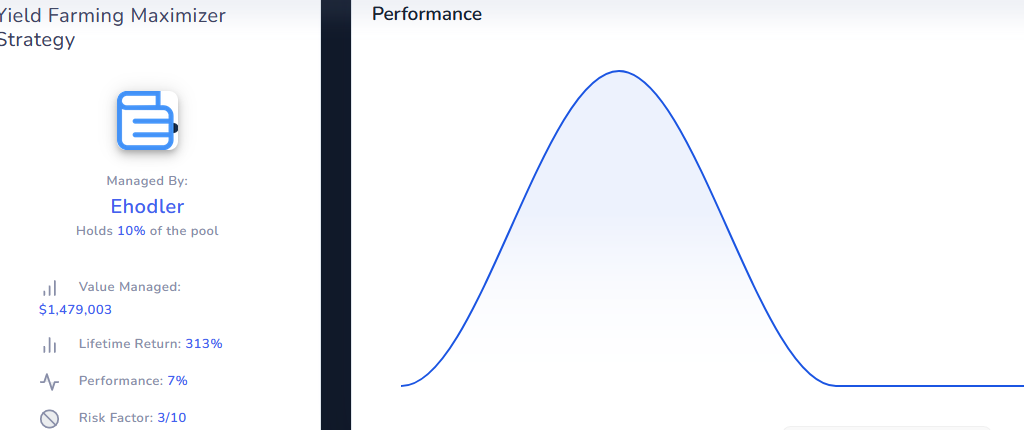

You can see the pool manager, lifetime return on the strategy, Performance, risk factor, accounts that can use the strategy , a performance chart, strategy description and illustration, Management fee , Portfolio breakdown and trade history for the strategy. I will explain how this features so investors can understand them better and use them when selecting a strategy.

Pool Manager: A pool manager is a person or company that manages investments on behalf of investors.

Performance: The average daily performance of a trading strategy is found out by calculating the percentage of winning trades against losing trades on any day. This information can be used by an investor to know how much a strategy could potentially yield.

Lifetime returns: Lifetime returns is the percentage returned earned by the strategy since it’s creation.

Account type: This indicates the type of investor account the pools allows.

Performance charts: This a chart illustrating the performance of the strategy over a period of time.

Strategy Description and Illustration: This is a detailed description and illustration of how the strategy works. You can read the description to understand the mechanics behind a strategy.

Management fee: This is the fee charged by the pool manager on the profits generated by the strategy.

Portfolios: This is a breakdown of digital assets that make up the strategy.

Trade history: A history of the trades carried out by the strategy.

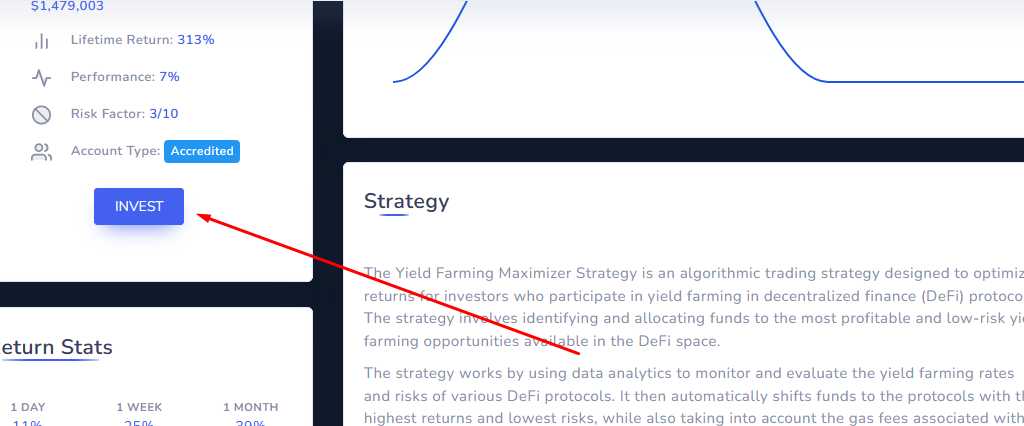

Carefully analyze the information on the strategy you intend to use and click invest.

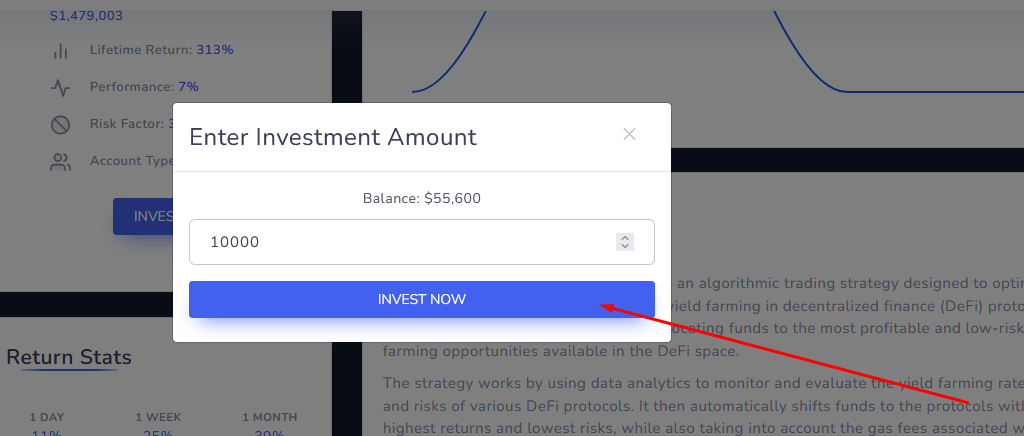

Enter the amount you intend to use on the strategy and click “Invest now”

The amount allocated will automatically be deducted from your wallet and allocated to the strategy.

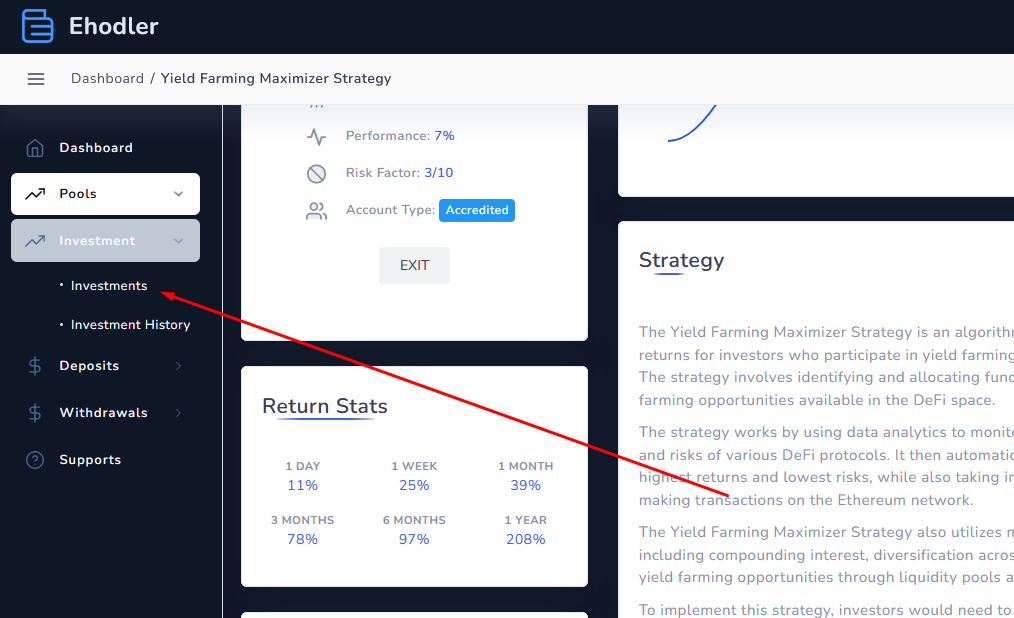

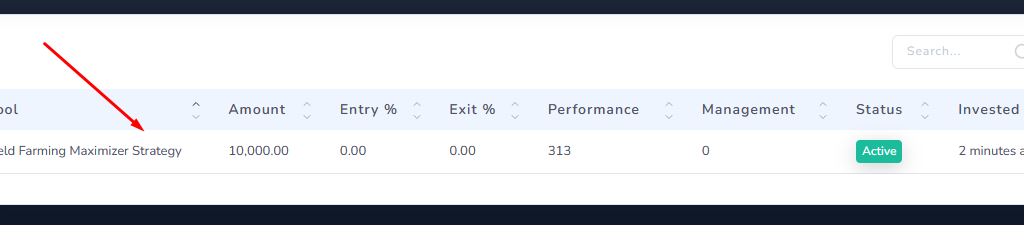

To monitor the progress of your investment select investment from the side panel.

Here you can monitor your investments alongside other protocols you are currently investing in.

To exit an investment strategy click on it from the investments tab and you will be redirected to the strategy page.

Click “EXIT” to exit the strategy and the returns together with your capital will automatically be credited to your wallet. You can then proceed to make a withdrawal or reinvest into any strategy of your choice.